Morning Report

Morning Report – Tuesday 10th November

Main Headlines

Pfizer and Biotech announced yesterday that their vaccine was 90% effective in combating COVID-19. The UK Government announced that they had already been offered 40 million vaccines and planned to distribute 10 million vaccines before 2021, starting with those most at risk.

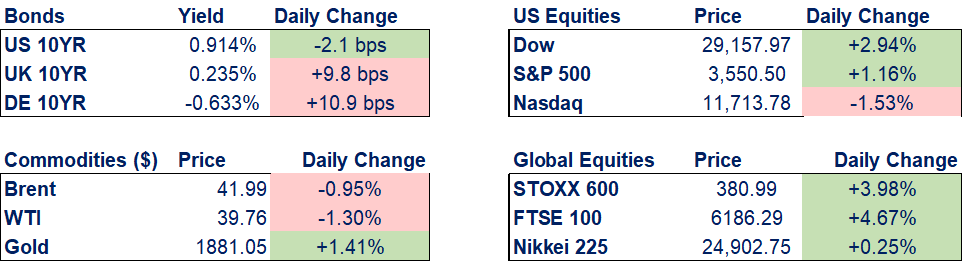

Vaccine news led to a global rally in stocks, especially for those hit hardest by the pandemic. At one point, the S&P 500 and Dow were trading at record highs however, momentum faltered just before the close. Euro Stoxx 600 benefitted most to gain 4% in the day, while the Tech heavy Nasdaq closed down 1.3%.

Boris Johnson has vowed to carry on with his Brexit bill that violates international law, despite defeat in the House of Lords. This will ire President elect Joe Biden, who has strong links with Ireland and recently warned against a bill that endangers a post-Brexit arrangement with Northern Ireland.

GBP

The pound is relatively flat against both the dollar and euro in early morning trading. Brexit talks continue today, with a view to finalise a trade deal by the 15th November deadline, but key differences still remain. ILO Unemployment rate for September came in in line with expectations at 4.8%, and Claimant count change surprised to the upside however, data is still skewed due to the furlough scheme.

EUR

The euro is slightly higher against the dollar in early morning trading today, after reaching a 2-month high yesterday. The EU have decided to take punitive tariffs worth up to $4 billion on US goods in retaliation against illegal state aid for Boeing. On the economic data front, Germany’s Economic sentiment indicator is expected to fall in November due to the heightened uncertainty over the pandemic.

USD

The dollar is unchanged against a set of major currencies this morning. Biden is reported to be ready to move onto picking cabinet positions despite Government agency administrators refusing to assist the political transition of power. The day is light on economic data releases, but the Supreme Court is expected to hear a case on lawfulness of the Obamacare Act.

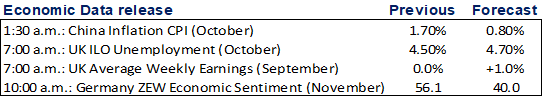

Main Economic Data/Central Banks/Government (All times GMT)

7:00 a.m.: U.K. Sept. Unemployment

7:00 a.m.: Turkey Aug. Unemployment

7:45 a.m.: France Sept. Industrial Production

9:00 a.m.: Italy Sept. Industrial Production

9:45 a.m.: Spain sells bills

10:00 a.m.: Germany Nov. ZEW Survey

2:00 p.m.: ECB’s Knot speaks at UBS conference

Corporate Events

Apple “One More Thing” online event

Earnings include Adidas, Deutsche Post, Henkel, Porsche, Siemens Energy