Morning Report

Morning Report – Tuesday 9th June

Main Headlines

Wall Street is back. The S&P 500 erased this year’s losses and is back in positive territory as lockdowns eased, fuelling gains for Asian stocks and European futures. The benchmark closed at a 15 week high, bringing its rally from the March low to almost 45%. The rebound has Ed Yardeni calling the selloff a “panic attack” rather than a true bear market. Treasuries rose and Brent got back to $41 per barrel.

The U.S. and Russia will hold a new round of nuclear arms talks this month. The two sides will meet in Vienna on June 22, and could discuss whether to extend the New Start treaty, which is set to expire in February. The Trump administration is pushing for China to join the negotiations but Beijing officials so far have balked, arguing their arsenal is far behind Washington and Moscow.

GBP

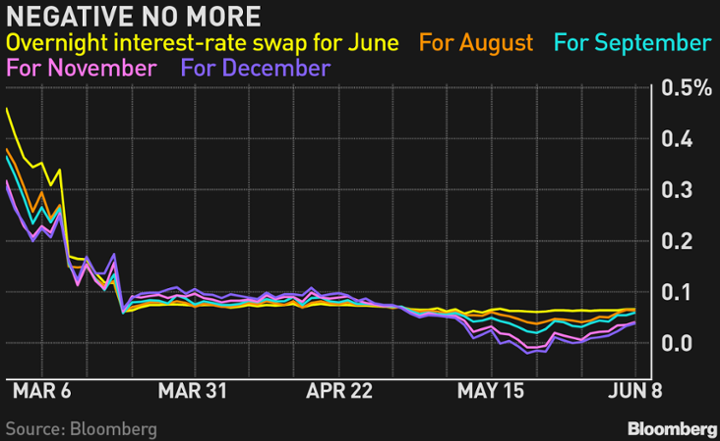

Sterling has held onto recent gains as plans to ease coronavirus lockdowns in Britain and signs the economy may bounce back due to pent-up demand kept the currency just below three months highs versus a basket of currencies. Analysts continue to warn of Brexit risks for the pound – which has rallied for seven consecutive days against the dollar – as talks on a future trade deal with the European Union after the UK’s exit fail to make progress. Money markets have shifted away from betting on a historic move by the BOE to take interest rates below zero. In mid-May, overnight interest-rate swaps indicated traders were anticipating sub-zero rates by year-end. They’re still positioned for a cut, but only by five basis points from the current 0.10%, betting instead that the bank will increase bond buying to help markets cope with a flood of sales by the U.K. government.

EUR

German exports and imports slumped in April, posting their biggest declines since 1990 as the coronavirus crisis slashed demand, adding to a gloomy outlook for Europe’s biggest economy, data showed this morning. Many economists believe the pandemic will push the German economy into its biggest decline since the end of World War Two in the second quarter. Despite a 130 billion euro stimulus package announced last week, which comes on top of 750 billion euros worth of measures announced in March, the government expects the economy to shrink by 6.3% this year.

USD

The dollar steadied this morning as profit taking stalled surging risk currencies, while a rising yen pointed to some investor trepidation over the U.S. Federal Reserve’s next move. The recent dollar weakness has subsided as investors weighed the possibility of stepped-up bond buying – or even simply a very dovish outlook – from the Fed, which meets on today and tomorrow. It is not expected to change interest rate settings though in recent days futures pricing shows investors have abandoned expectations of rates dipping below zero next year.

Main Economic Data/Central Banks/Government (All Times BST)

- 7:00 a.m.: Germany April trade

- 7:45 a.m.: France April trade

- 9:00 a.m.: ECB’s Rehn speaks

- 10:00 a.m.: Euro-Area 1Q GDP, employment, household consumption

- FOMC meeting commences